July 2023 Archive: practical takeaways on franchises, submarines, and education loans

July 2023 brought three focused pieces that answer specific, practical questions readers often ask. You’ll find concise costs and requirements for a big franchise, a plain explanation about TV reception on submarines, and a realistic look at banks and 0% education loans for girls. Each post gives clear numbers and next steps so you can act fast.

Quick summaries you can use right away

What does a Dave & Buster's franchise cost? The post breaks down the typical initial investment at about $2–$4 million. That covers construction, gaming and kitchen equipment, initial inventory, and franchise fees. You also need a net worth around $1.5 million and roughly $500,000 in liquid assets. If you’re weighing the idea, focus first on financing options, location lease terms, and realistic opening timelines—those drive how fast the business can start earning.

Can submarines get regular TV channels? Short answer: no. Regular broadcast and cable TV signals don’t reach deep underwater. Submarines rely on onboard entertainment systems, recorded content, and secure internal communications. When on the surface or near shore they can pick up satellite or shore-based signals, but while submerged they use internal networks and limited low-frequency communications for mission info—not TV channels. If you’re curious about life onboard, know that crews use preloaded media and scheduled uplinks rather than live TV.

Are there banks offering 0% education loans for girls? That’s rare. The July post explains most banks charge interest, though some offer reduced rates or special schemes aimed at supporting girls’ education. Government programs, NGOs, and scholarship funds are often the better route for interest-free or grant-style support. If you want help, collect a shortlist of banks, ask about special offers for women or students, and compare total costs—not just headline rates.

How to act on these posts

If you’re exploring a franchise, use the numbers as a checklist: confirm your net worth and liquidity, estimate build-out costs for your specific location, and talk to lenders about commercial franchise financing. For submarine tech curiosity, think in terms of communications constraints: plan for offline entertainment and periodic data uplinks rather than continuous streaming. For education funding, contact banks and local education offices, and look for government or NGO programs that target girls—sometimes grants and subsidies beat cheap loans.

Each July post is short, practical, and meant to save you time. Want more detail on any of these topics? Ask a specific question and we’ll pull the numbers or checklist you need next.

What is the startup cost for a Dave and Buster's?

Starting up a Dave and Buster's franchise is not a small financial endeavor. From my research, the initial investment typically ranges between $2 to $4 million. This amount covers costs like construction, equipment, initial inventory, and franchising fees. Keep in mind, you'll also need to prove a net worth of $1.5 million and liquid assets of around $500,000. Remember, these are big numbers, but it's for a business model that has proven to be quite successful.

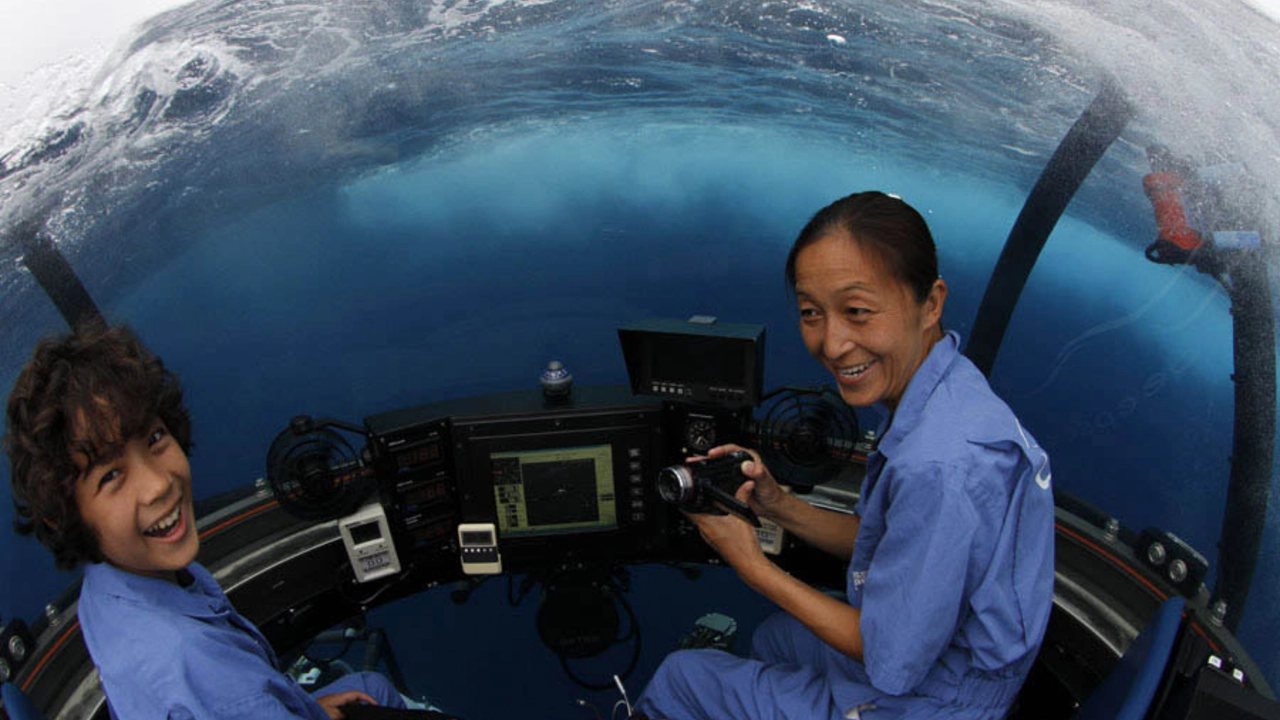

Are there TVs in a submarine that can receive regular channels?

In today's post, we're going to delve into the intriguing world of submarines and their amenities. Specifically, we're addressing the question: can submarines receive regular TV channels? The short answer is no, they can't. Due to the nature of their operations deep underwater, submarines can't receive direct signals required for regular TV channels. Instead, they rely on internal communication systems for information and entertainment.

Which banks offer an education loan for girls at 0% interest rate?

In my research on banks offering 0% interest rate on education loans for girls, I discovered that this kind of offer is quite rare. Most banks attach a certain interest rate on education loans, however, some banks may offer lower rates for women as part of their initiatives to encourage female education. It's important to thoroughly check with different banks and financial institutions about their loan policies. Also, some governments or non-profit organizations might have special schemes to support girls' education. Always remember, before signing any loan agreement, understand all terms and conditions.